Face Match: How to Apply It to Your Onboarding Process

Published on

28/04/2022

| Updated on

17/11/2025

Topics Covered

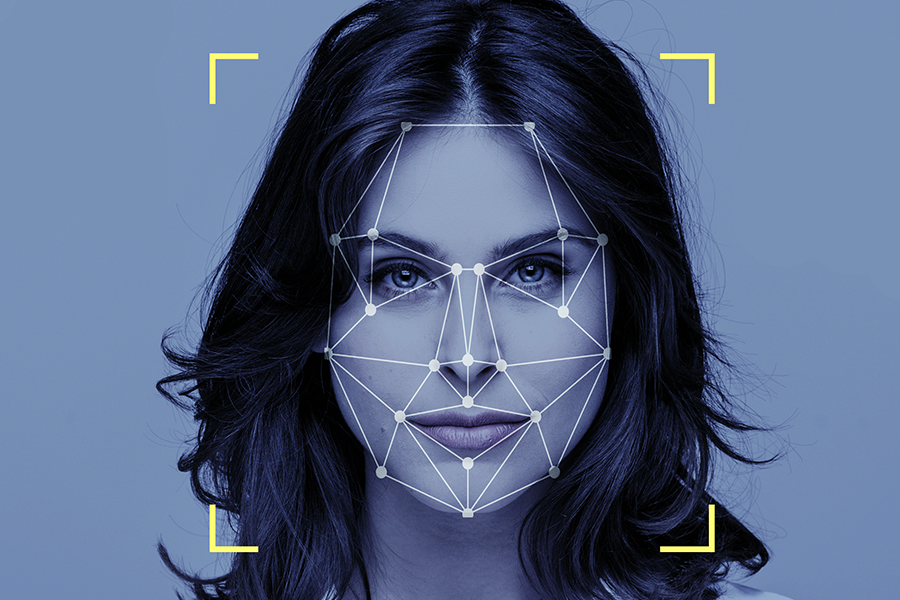

Face Match is a facial recognition technology widely used for user authentication. Through Artificial Intelligence, it scans a person’s face and compares it to photos stored in public or private databases.

The Fourth Industrial Revolution, or Industry 4.0, has profoundly reshaped production processes over the last decade. In this scenario, adapting to digital transformations is a primary necessity for companies to remain relevant in the market.

However, as process flows have migrated to digital platforms, the strategies and technologies used by fraudsters have also become more sophisticated.

In this context, investing in technological solutions that allow for more secure data management has become fundamental. Generally, these technologies are highly effective, making it possible to reduce up to 90% of identity fraud with the use of a combination of tools.

Face Match emerges as a key solution aimed at protecting an individual’s identity through facial recognition. It is, therefore, a powerful tool that has a major influence on the identity verification process.

Continue reading to understand the advantages of applying Face Match to your onboarding process!

So, What is Face Match?

Face Match is simply a feature based on an Artificial Intelligence system, developed to identify and compare various facial points. In short, the system automatically compares a selfie with the person’s document photo (an ID card, for example) and determines if it is the same individual.

In other words, it performs a “face-to-ID check” when applied in the digital onboarding process.

This facial recognition process offers an extra layer of protection, preventing scams and fraud against organizations. It is also a faster and more practical resource in the KYC (Know Your Customer) process, bringing more agility, quality, and cost reduction to your onboarding processes.

The Importance of Customer Validation

Given the increase in fraud, information theft, and the risk of data breaches, customer identity verification has become a priority for companies.

According to a survey by Serasa Experian, there is an identity theft attempt every 7 seconds in the country. Banks, financial institutions, and service companies are the biggest targets for bad actors.

Therefore, Face Match presents itself as an important customer verification mechanism. The AI systems operate quickly and accurately, ensuring the integrity of the analyzed information and, consequently, providing more security for your business.

With Face Match, it is possible to reduce risks, improve onboarding processes, and quickly verify the identities of all your customers.

It is worth noting that this technology is used in various situations, such as:

- Opening a bank account;

- Requesting a loan;

- Authenticating a payment;

- Performing a liveness check;

- Obtaining social benefits;

- Registering with companies and stores in various segments.

What are the main benefits of investing in Face Match?

Among the numerous applications of Face Match, as we’ve seen, the customer onboarding process is what most attracts companies’ attention. The main reason is user drop-off during registration or when continuing to use services due to delays, as some companies still use manual anti-fraud analysis systems.

Here are the main benefits of Face Match in the customer onboarding process:

Process automation: With the application of facial recognition, customer onboarding and identification processes are fully automated, ensuring greater accuracy during the operation.

Security: Biometric information is harder to steal than other traditional authentication types, such as passwords. By detecting facial points, it’s possible to ensure that the person accessing the system is not using someone else’s ID photo.

Process agility: By automating your company’s registration processes, you receive a result in minutes and can accept more customers. In other words, profits also increase automatically.

Integration with other systems: Face Match integrates well with other anti-fraud and security layers already used by institutions, in addition to being considered simple to program.

Better user experience: By being a faster and more practical procedure, the user has a better experience during identification. Therefore, it’s not necessary to repeat the request or deal with other red tape. Furthermore, the company builds a more complete database, which implies more security for its customers.

As you can see, Face Match represents a true transformation in the market. BGC offers a series of anti-fraud solutions combined with cutting-edge technologies. By combining Face Match with document validation and OCR functionality, you ensure your company’s protection against increasingly sophisticated fraud.

Now that you know this technology better and understand its importance within validation processes, dive deeper into this and other topics in a chat with our experts. Schedule a conversation!

Share:

Time de conteúdo

Related posts

Free materials

Technology in HR

How to automate processes and make them faster and safer

E-book

Background Check

7 ways to apply it in your company

E-book

10 pillars of a

Compliance Program

E-book

Best practices guide for

Money Laundering Prevention (MLP)

E-book

The Future of HR

7 Global Trends You Should Adopt as Soon as Possible

E-book